The Leveraged Distribution Strategy®

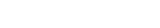

LIVING BENEFITS OF LIFE INSURANCE

The Leveraged Distribution Strategy® is our proprietary method of harnessing the benefits of permanent life insurance coupled with leverage from our lender network to create significant *tax-free growth and supplemental tax-advantaged retirement income.

What has been made clear to us is the overwhelming focus on asset accumulation strategies to help clients save and invest within the wealth management industry. There are many accumulation strategies to allocate capital, such as qualified plans, brokerage accounts, private equity, real estate etc. With so much attention on wealth accumulation strategies, we have found a deficit in regards to distribution planning for clients among the advisor community. Distribution Planning is more difficult, and the mistakes can be very costly.

If you are wealthy and plan to stay wealthy, your accumulation and distribution strategies should address the following:

- What will your balance sheet look like when you are retired?

- How much tax drag do you have on your assets now and in the future?

- Are you better off focusing on Asset Location and not just Asset Allocation?

- How correlated with the equity markets are your assets?

- How will you generate solid tax efficient growth and cash flow throughout your life?

- What will your tax bracket be in retirement?

- What are your tax ‘triggers’ now and in retirement?

- What is the impact of long-term flat and/or volatile markets?

A well designed life insurance strategy can help address many of these issues, and much more. To better understand this, it’s important to uncover all the Living Benefits associated with life insurance contracts. Most of the Living Benefits associated with life insurance can be significantly enhanced with our Leveraged Distribution Strategy. TLDS enhances the unique nature of life insurance by adding additional premiums and contributions from specialty banks, multiplying and enhancing these great benefits:

Competitive Upside Capture

Not only can you have downside protection from the markets, you can also secure Upside Capture when stock markets are positive, up to cap. For example, many policies have a Cap on the S&P for 10%-12%. Meaning, if the S&P were to go up 20%, you could have interest credited and locked in to your cash values, up to the policy's current Cap.

Downside Protection

With many cash value life insurance policies, your money is protected against the volatility associated with equity markets. Although your cash value returns may be driven by stock market performance, you are guaranteed to not lose principal. In many Index Universal Life policies, for example, the minimum guaranteed interest a policy will earn can be 0% and in some cases 1%. Meaning, if the stock market drops 20%, you are guaranteed to have interest of 0% or 1%, depending of the insurance policy.

Tax-free Growth & Distributions

Life insurance cash values accumulate tax-free. It is very difficult to compete with tax-free compounding. In addition, the cash values can be accessed in the future tax-free via policy loans, without affecting Social Security Taxes & Medicare Premiums. The policy loans you take are NOT counted as reportable income and will not affect your Adjusted Gross Income, unless your surrender the policy and have taken out more than your cost basis. Think about all the income from your investments you are now paying taxes on. Do you actually need the income now? Do you need all the income that is being produced?

No Contribution Limits

Maximizing contributions to your Qualified Plan are likely not going to be enough to support your retirement income needs. Even if you could put in substantial contributions and receive a current deduction, would you want the majority of your retirement income to show up as taxable income in retirement? I'm guessing you would not. However, the IRS absolutely would. If it's a good deal for them, it's likely not a good deal for you. What is the best way to position your balance sheet over time to become tax efficient? You are allowed to make substantial contributions to a life insurance policy over time that can allow you to accumulated and distribute significant tax-advantaged income. Our Leveraged Distribution Strategy has the potential to further enhance this value proposition. With a bank making even larger premium payments of your behalf, you have the opportunity to create an even better benefit for yourself.

Sequence of Returns Risk

Imagine you are now retired and you have $1,000,000 in an investment account. You need to withdraw $50,000 a year to cover a portion of your living expenses. The investment portfolio drops 15% to $850,000 and you take out the $50k. It is now worth $800,000. How likely are you to get a return in the following year of 25% to bring your balance back? What if you have another negative or flat year? Being diversified in your portfolio can certainly help you smooth out your returns, but is does not prevent you from experiencing losses. The risk is significantly magnified if this were to occur at the beginning of your retirement, depleting the principal that you may so desperately need to support you through a possibly long life expectancy. With your life insurance cash values protected against market drops such as this one, you can rest more easily at night. Our job is to help you grow and protect your wealth.

Creditor Protection

Most States allow for the life insurance cash values to be protected from creditors, even with no dollar limits. This is why so many high risk people, such as doctors and business owners, fund significant amounts into their policies. If a trust is the beneficiary of the policy, the death benefit proceeds may also receive the benefits of creditor protection as well.

Liquidity, Use and Control

Did you know that you can access the cash value of a life insurance policy without penalty before 59.5? In most cases, withdrawing money from an IRA, 401k or annuity before this age will result in not only income taxes, but an additional 10% tax penalty.

Guaranteed Loan

Cash Values can be accessed free of tax with policy loans. However, this is not your typical loan. The cash value belongs to you, so you are essentially the bank. Generally, you can borrow up to the amount of your net cash value. The interest due of the loan is typically added to the loan balance. The loan is repaid back at death. The difference between the loan balance and the Total Death Benefit represents the Net Death Benefit. This is the amount that is paid income tax-free to your beneficiary. However, if the policy becomes a Modified Endowment Contract by overfunding premiums beyond the limits, the loans are considered taxable.

Leverage

For almost 4 decades, banks have been providing financing to support large premium payments into life insurance policies for high net worth individuals, families and businesses. Tennyson's Leveraged Distribution Strategy incorporates the use of leverage into the design of a life insurance policy to provide an attractive death benefit, cash value growth and significant tax-advantaged income potential in retirement. Clients may be able to finance a portion of their insurance premiums. In doing so, significant cost savings can be recognized, therefore increasing the internal rate of return on the policy.

*All TLDS structures are designed in accordance with IRC7702 rules and as illustrated are NOT Modified Endowment Contracts (MEC). Any future premiums, or face amount or rider changes could create a taxable event. Any changes should be carefully reviewed, and potential issues discussed with your tax advisor prior to making the change.

*This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified advisor.